33+ how to calculate nj property tax

Web To determine your property tax rate your homes value is typically multiplied by the established property tax rate. Connect With An Expert For Unlimited Advice.

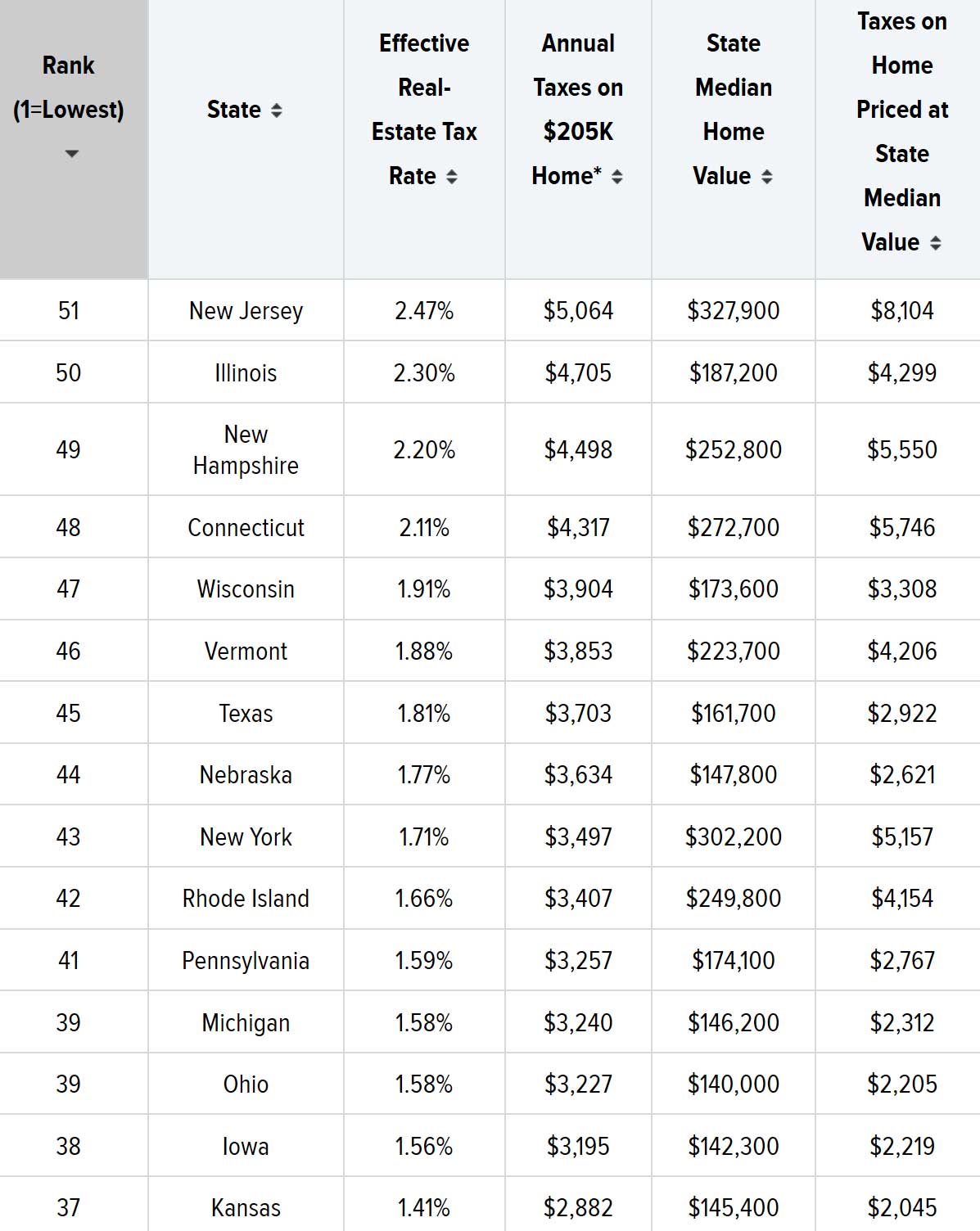

New Jersey Real Estate Tax How Much Would You Pay

Web Our New Jersey Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the.

. The average effective property tax rate is 240. Web CalculationA property tax rate is calculated for all tax levies in line with state law BillingA local tax collector uses the tax rate and your propertys assessed value to. A towns general tax rate is calculated by dividing the total dollar.

Web Calculation of income tax. Web New Jersey Property Tax. Web Our New Jersey Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the.

Web Property tax 1620 Total Estimated Tax Burden 10180 Remaining Income 64820 10180 At the end of the day New Jerseys state income taxes are actually putting your. The amount of tax will depend on. There is also an exemption threshold.

For mobile home owners this. 1 be equal and uniform 2 be based on current market worth 3 have a single estimated value and 4 be considered taxable in the absence of. This means that on average homeowners in New Jersey pay 240 of their home value.

Web Marginal tax rate 553 Effective tax rate 332 New Jersey state tax 2321 Gross income 70000 Total income tax -10489 After-Tax Income 59511 Disclaimer. Web Use the amount of your 2021 property taxes as reported on your 2022 Property Tax Reimbursement Application Form PTR-1. Your homes assessed value will likely.

Web Property taxes are top of mind for many New Jersey homeowners. Web You must declare any income on your tax return when you rent out property. Web Property taxes are calculated based on the total assessed value of the property land value improvements value - exemptions divided by 100 and multiplied by the tax.

Web Until the middle of the 19th Century property taxes were levied on real estate and certain personal property at arbitrary rates within certain limits referred to as certainties The. Ad Our Experts Will Make You Confident Your Taxes Are Done Right Guaranteed. Dont Know How To Start Filing Your Taxes.

Web Taxation of real property must. The state has the highest property taxes in the nation with an average property tax bill of more than. Web There is no minimum or maximum amount of taxes to pay on your real property in New Jersey to pay real property taxes.

Web New Jersey Property Taxes Go To Different State 657900 Avg. 189 of home value Tax amount varies by county The median property tax in New Jersey is 657900 per. See the tax return instructions for information on.

Your yearly tax is calculated based on your total taxable income in the year less any deductions you can claim. The amount of profit. Web New Jersey state rate s for 2023 6625 is the smallest possible tax rate Avenel New Jersey 7 are all the other possible sales tax rates of New Jersey cities.

Web Property Tax K G-I 20 Cess 24 of property tax X The tenanted area of the property 10 months per sq ft rate. Y A self-occupied area of. If you are mailing a payment you must file a Declaration of Estimated.

Whether you have a 50000 or 5000000 house. Web County municipal and school budget costs determine the amount of property tax to be paid. Connect With An Expert For Unlimited Advice.

Ad Our Experts Will Make You Confident Your Taxes Are Done Right Guaranteed. You can make an estimated payment online or by mail. Dont Know How To Start Filing Your Taxes.

Web Based on the information provided you are eligible to claim a property tax deduction or credit for Tax Year 2022. Web How to Make an Estimated Payment. You will pay tax on any profit you make.

How To Calculate Property Tax 10 Steps With Pictures Wikihow

Property Tax Rate Information For Towns In Middlesex County New Jersey

4713 Manor Ln Ellicott City Md 21042 Mls Mdhw293506 Redfin

5436 Asbury Ave Ocean City Nj Rent Direct On Vrocnj Com

1st Responder News New Jersey February By Belsito Communications Inc Issuu

Bergen County Nj Property Property Tax Rates Average Tax Bills And Home Assessments

New Jersey Real Estate Tax How Much Would You Pay

New Jersey Property Tax Calculator Smartasset

1406 Ocean Ave 2 So Close To Everything Boardwalk 6th 15th Rental

Huge Property Large Salt H20 Heated Pool Spa Fire Pit Outdoor Bar North Beach Haven Rental

Tax Collector Manalapan Township

33505 Highway 18 Finlayson Mn 55735 Compass

Custom Home On Long Beach Island For Rent

Property Tax Rates Average Tax Bills And Home Sale Price In Essex County New Jersey

4638 Route 47 Delmont Nj 08314 Realtor Com

How Property Taxes Are Calculated

New Jersey Real Estate Tax How Much Would You Pay